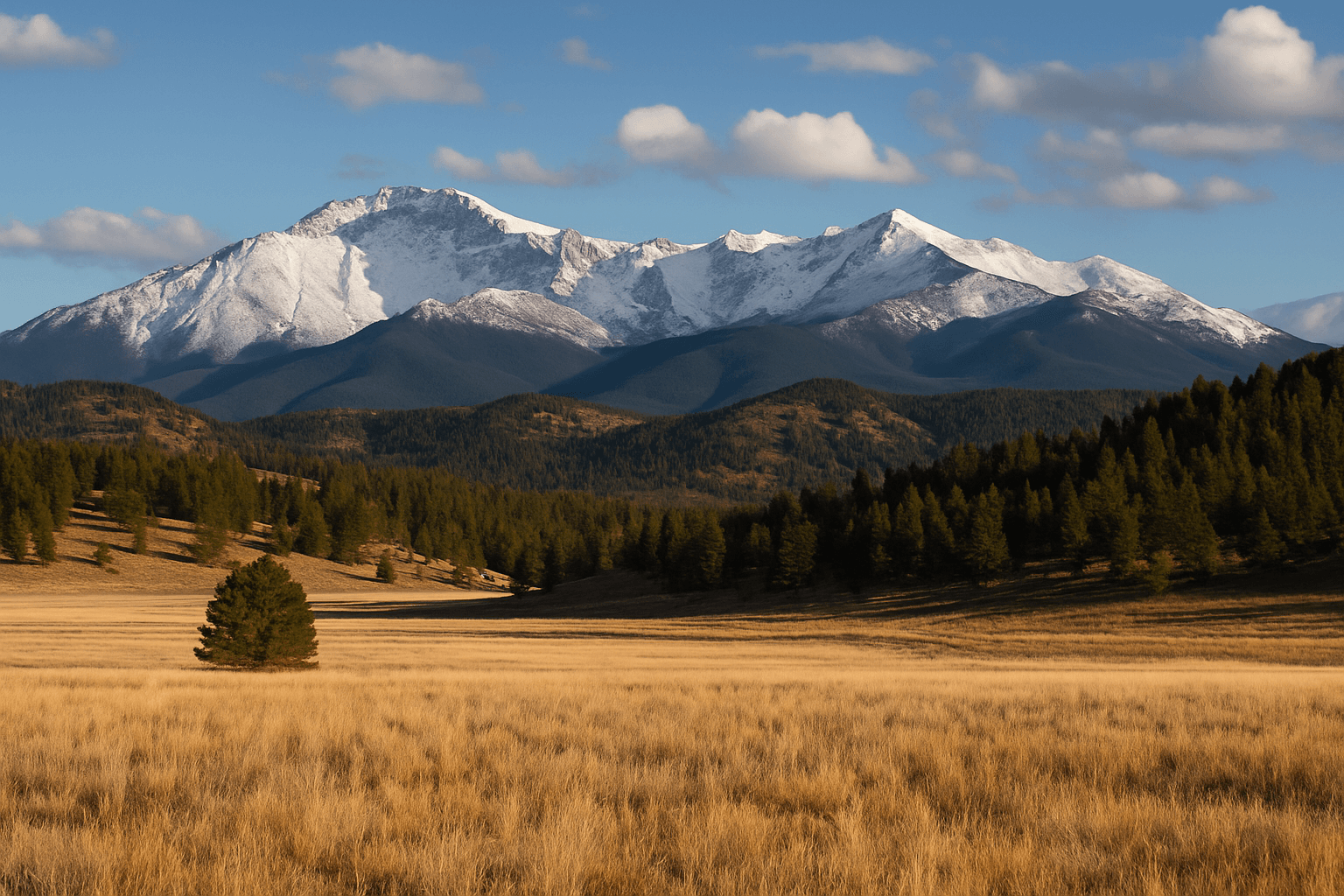

Why Colorado land is holding value in 2025

Despite higher interest rates, demand for Colorado land remains strong. A 2025 outlook across the Mountain West shows values staying near historic highs, fueled by low inventories and high-quality listings like recreational and scenic parcels .

Key trends shaping investment today

- Persistent demand + limited inventory Rural land continues to command premium prices due to supply shortages—especially for parcels with unique features or access to outdoor activities .

- Eased buying pressure = room for smart buyers Rising borrowing costs have tempered frenzied buying. Investors now have more time for due diligence without the urgency of previous years .

- Strong signals for investor opportunity Early 2025 data shows Colorado property values appreciate by approximately 1.1% year-over-year, reflecting market normalization and still favorable conditions for buyers and investors .

Investment Considerations for 2025

| Factor | Why It Matters |

|---|---|

| Interest Rates | Elevated rates can limit affordability—consider cash purchases or creative financing. |

| Location Demand | Proximity to Denver, recreation zones, or rural peace impacts property desirability. |

| Utilities & Access | Off-grid properties need alternative systems; front-range parcels may offer easier buy-in. |

| Land Use Potential | Agricultural, residential, or investment-zoned land may yield long-term benefits. |

| Long-Term Outlook | Moderate appreciation still offers upside for patient buyers and developers. |

Final Thoughts — Still a Strong Market

Colorado remains a smart investment destination for land buyers in 2025—especially those targeting scenic, rural, or recreational properties. While the market’s pace has cooled, the fundamentals stay compelling: limited supply, natural beauty, and growing regional demand.

Interested in teaming up with a land expert or browsing properties ready for investment? Start exploring listings today »

Join The Discussion